Corporate Governance Policy

Regarding Corporate Governance

Basic Concept

In order to meet society's expectations and fulfill its responsibilities to society by providing economic and environmental value, the J-Oil Mills Group has established a system for executing business operations and a system for monitoring and supervision in accordance with the Companies Act.

The Group ensures that its internal control system, which was established in accordance with the Companies Act and the Financial Instruments and Exchange Act, is operated properly, and the effectiveness of the system is improved by conducting internal audits and correcting any deficiencies.

In order to realize honest and transparent management that can earn the trust of stakeholders, we are strengthening our corporate governance and enhancing our internal controls with the aim of improving its implementation.

最新のコーポレートガバナンス報告書は下記よりご覧いただけます。(2025年7月 更新)

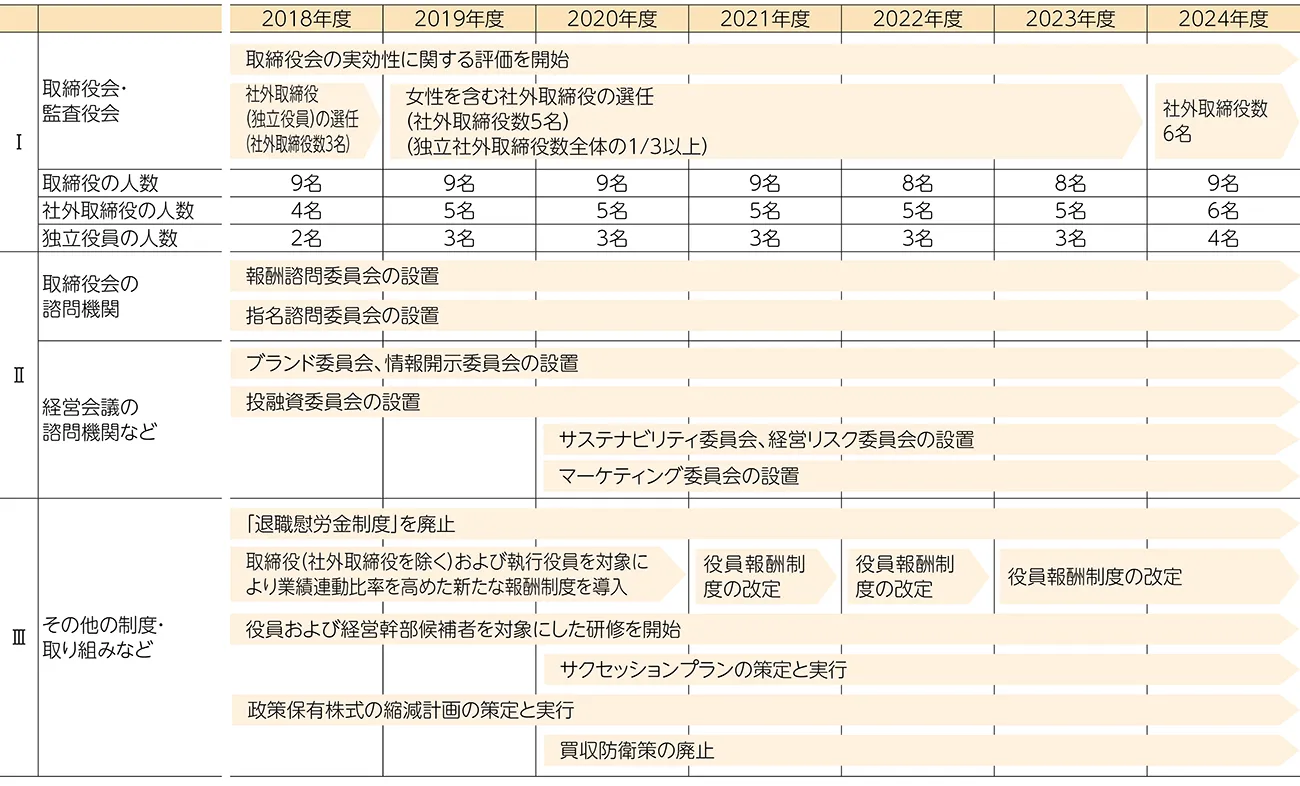

History of efforts to improve governance

Basic capital policy

In order to increase our corporate value, we will implement appropriate capital policies after understanding our capital costs. In addition, we will balance our operating cash flow and external fund procurement among growth investments, including M&A, capital investments, and shareholder returns.

By setting targets for ROE and ROIC as important management indicators, we aim to create an optimal capital structure that matches our business structure and realize a structure that stably exceeds our cost of capital.

With regard to dividends, we aim to allocate cash flows generated through expanding earnings to investments for growth, while at the same time aiming for a consolidated dividend payout ratio of 40% in order to steadily and continuously increase returns to shareholders.

Presence or absence of takeover defense measures

It was abolished at the conclusion of the Ordinary General Meeting of Shareholders for the fiscal year ended March 31, 2020.

Policy regarding cross-shareholdings

The Group has a policy of holding the minimum amount of shares deemed to contribute to the enhancement of its corporate value in the medium to long term, and gradually reducing such holdings.

We will hold the minimum amount of shares that are deemed to contribute to improving our corporate value. When deciding whether to hold shares, we will confirm the significance of holding them individually from various perspectives, such as the economic rationale of holding them and the likelihood of improving profitability. Shares that are deemed to be meaningful to hold will be verified regularly by the Board of Directors. For shares whose appropriateness for holding cannot be confirmed, we will proceed with selling them only after obtaining the full understanding of the business partner.

Furthermore, even if the Company recognizes the significance of holding certain shares, the Company may sell them in accordance with its basic policy for reducing cross-shareholdings, taking into consideration the market environment, management and financial strategies, etc.

Voting standards for cross-shareholdings

We will comprehensively determine whether an investment will contribute to the sustainable growth and medium- to long-term corporate value of the investee company in accordance with the following criteria, with the premise that it will contribute to improving our corporate value.

- Quantitative evaluation: safety, profitability, performance, dividend payout ratio, impairment risk due to falling stock prices, etc.

- Qualitative assessment: significant subsequent events, notes regarding the going concern assumption, unusual opinions of accounting auditors, significant illegal or antisocial acts, etc.

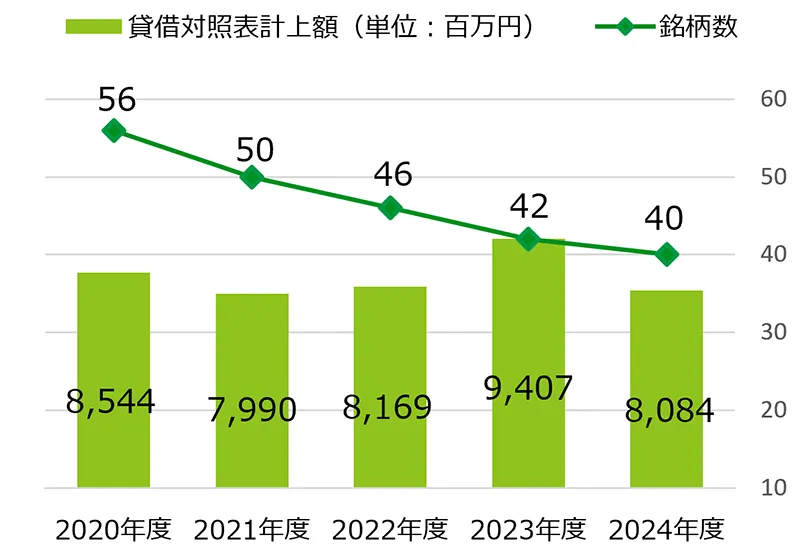

2024年度の状況

当社保有の政策保有株式のうち3銘柄(売却金額1046百万円)の売却を実施し、このうち1銘柄の全株売却を実施しました。

Trends in the amount of securities recorded on the balance sheet (by submitting company) and the number of issues

Other policies, etc.

Other regulations and policies of our group can be found below.

https://www.j-oil.com/sustainability/esg/policy.html