Disclosure Policy

1. Basic Policy on Information Disclosure

In order to achieve sustainable growth and increase in mid- to long-term corporate value, we aim to achieve honest and transparent management that can gain the trust of stakeholders, and are strengthening corporate governance and enhancing internal controls. We appropriately disclose financial information such as the company's financial condition and business performance, as well as non-financial information such as management strategies, business issues, risks in business activities, and information related to corporate governance, in accordance with laws and regulations. In addition to disclosures required by laws and regulations, we also provide information in an appropriate manner as necessary, and provide explanations and dialogue with shareholders directly or indirectly.

We have established a system to ensure that information that may have a significant impact on investment decisions is made available equally to all market participants by disclosing it in accordance with timely disclosure rules and, if necessary, posting it on our website or disclosing it to the media.

By disclosing information to shareholders and other stakeholders in a timely, proper and fair manner, we strive to enhance our credibility as a company and receive a fair valuation of our enterprise in the capital markets.

If we discover that any information previously disclosed is incorrect, we will promptly correct and disclose the error. We will also promptly update the information if there are any significant changes in circumstances.

2. Approach to dialogue

In order to achieve sustainable growth and increase in mid- to long-term corporate value, the Company recognizes that one of its important management issues is to appropriately reflect shareholder opinions in management, and the Chief Financial Officer will oversee dialogue with shareholders and investors to obtain their understanding of the Company's management strategy and management plans. In addition, by reporting opinions gained through dialogue to the Board of Directors as necessary, the Company will strive to achieve a balanced understanding of the positions of various stakeholders and to respond appropriately based on that understanding.

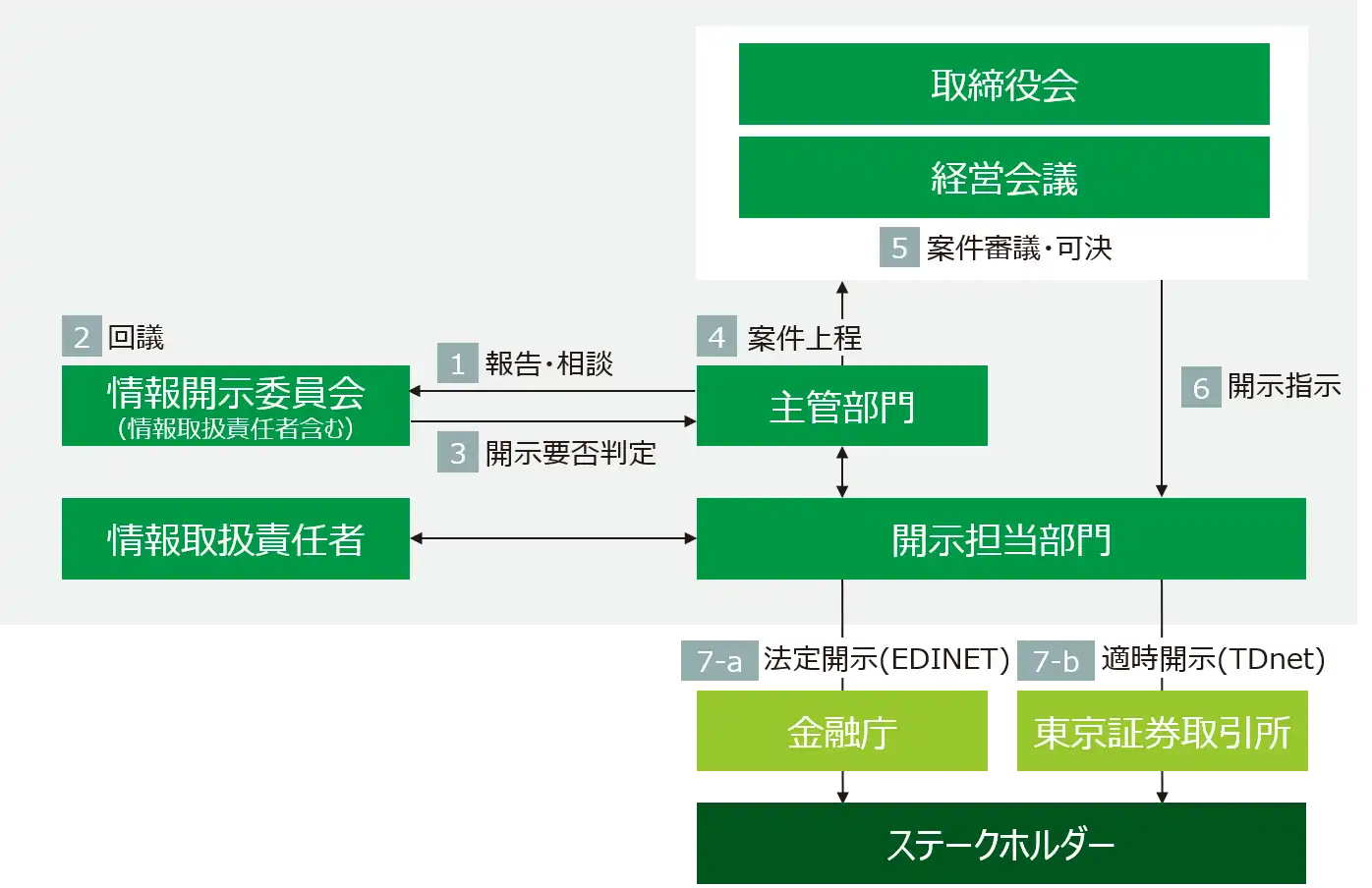

3. Internal system for timely disclosure of important facts

当社は、情報取扱責任者、法定開示・適時開示に関係する部門の責任者で構成する「情報開示委員会」が会社の重要情報の開示に関する審議・要否判定を行うこととし、取締役会・経営会議が開示を指示します。また、監査役および会計監査人から定期的な監査に加え、助言・指導を受けます。なお、審議・決定等に際して、必要に応じて弁護士をはじめ社外専門家の助言・指導を受けます。

Information Disclosure System

4. Definition of Material Information and How to Disclose It

(1)適時開示情報

With regard to important information relating to the business, operations or performance of a company that may have a significant impact on investment decisions regarding securities and that is required to be disclosed pursuant to the timely disclosure rules established by financial instruments exchanges (such as information on decisions, occurrences and financial results relating to listed companies and subsidiaries), we will carry out disclosure procedures in accordance with the timely disclosure rules established by financial instruments exchanges, and will post such information on our website as necessary and make it public to the media.

(2)フェア・ディスクロージャー・ルールの対象となる重要情報

We strive to appropriately manage undisclosed important information about the company's operations, business, or assets that may have a significant impact on investors' investment decisions, but in the unlikely event that such information is communicated to some of the parties involved in the transaction, we will disclose it in accordance with the Fair Disclosure Rules (Article 27-36 of the Financial Instruments and Exchange Act and the Cabinet Office Ordinance on Disclosure of Material Information). If necessary, we will post the information on our website and disclose it to the media.

(3)法定開示情報

We will disclose important information that is required to be disclosed statutorily under the Financial Instruments and Exchange Act in an appropriate manner in accordance with the law. If necessary, we will post such information on our website and make it public to the media.

5. Preventing insider trading

In order to properly manage important information and prevent insider trading, the Company has established internal regulations and is promoting awareness-raising activities and thorough dissemination of these regulations throughout the Group.

6. Improving fairness in access to information

In order to provide investors with fair access to timely disclosure, the Company will disclose information on its website in addition to filings with each stock exchange and issuing press releases, all of which will be done at the same time.

If a spokesperson designated by the Company unintentionally discloses important non-public information at an investor briefing or other event, the Company will promptly make a timely disclosure of that information. Similarly, if important non-public information that should be disclosed in a timely manner is disclosed by a third party prior to the Company's disclosure, the Company will promptly make a timely disclosure of that information.

7. Quiet Period

In order to prevent the leaking of financial information, the Company will observe a quiet period from the day after the closing date of this fiscal year and each quarter until the announcement of the financial results, during which time the Company will refrain from making any new comments related to financial information. However, if there are any prospects during this period that are significantly different from the previous performance forecast, the Company will disclose such information in accordance with the timely disclosure rules. However, even during the quiet period, the Company will respond to inquiries regarding information that has already been made public.

8. Future outlook

The plans, future prospects, strategies, etc. of the Group published in our disclosure materials, other than those related to past or present facts, are forecasts of future performance and are based on the judgments and assumptions of our management team using information currently available to us. Therefore, actual performance may differ significantly due to uncertainties, economic conditions, and other risk factors.

In principle, we will not comment when a third party expresses an opinion about our future plans. However, if there is an obvious factual error or mistake in the third party's comment, we may point it out on our website.

9. Responding to market rumors

We do not comment on market rumors, either confirming or denying them.

当社に対して流布されている噂や報道が資本市場に大きな影響を及ぼすと認められ、真偽を明らかにする必要があるときには、適時開示情報伝達システム(TDNet)等を通じて、適切に情報を開示します。